The Re-Beginnan | Vol.2 | Issue 12

While announcing the fifth and the last tranche of INR 20 lakh crore ‘Atmanirbhar Bharat Abhiyan’ package in light of Covid19 impact, the Finance Minister made a huge revelation that except strategic sectors, every PSU (Public Sector Undertaking) in India shall be privatized. Also, strategic sectors have been identified which shall not have more than four Central Public Sector Enterprises (CPSEs). The need for a coherent policy (Public Sector Enterprises Policy) which allows private players to enter all sectors as a part of ‘Atmanirbhar Bharat Abhiyan’ has also been expressed by the Finance Minister in the past.

Upon implementation, the government shall exit non-strategic sectors through privatization or strategic disinvestment. In strategic sectors, at least one but not more than four PSU will operate along with private players. If the number of government enterprises exceeds more than four, they will be either privatized, merged, or brought under holding companies.

After Atal Bihari Vajpayee’s plan of withdrawing from the public sector in 2000, this will be the most ambitious disinvestment move.

Need for Privatization — Government’s Point of View

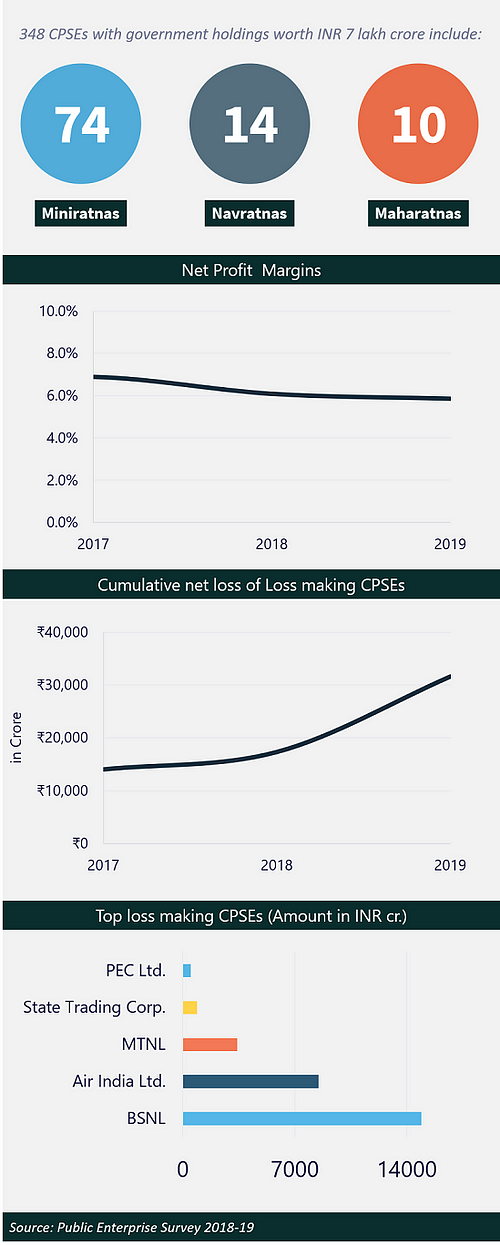

Some common reasons for losses/sickness in CPSEs include old and obsolete plant & machinery, outdated technology, low capacity utilization, low productivity, poor debt-equity ratio structure, excess manpower, weak marketing strategies, stiff competition, lack of a business plan, dependence on government orders, heavy interest burden, high input cost, resource crunch, etc. With privatization, the government aims to resolve these issues and revive the CPSEs within a competitive environment.

Operations of the CPSEs will not remain dependent on the share of the taxpayers’ money and can instead explore conventional sources of funds such as equity without many hassles. Privatization will induce best management practices by bringing in more strategic leadership in the CPSEs which shall be key for CPSEs to remain sustainable in the longer run. CPSEs can achieve higher levels of efficiency through implementation of advanced technology leading to innovative and better-quality products within a cost-effective range.

In certain sectors, private companies pose threat to the CPSEs with competitive pricing and thus adding pressure to the profitability of the CPSEs. Nonetheless, privatization will minimize the overall purview of the government departments allowing them to be more agile and focused on other critical areas. Government funds not diverted to CPSEs will also be available to meet other growth and development plans. Overall, moving towards privatization can foster the CPSE Disinvestment Programme of the central government and help achieve the objective of creating a transparent and corruption less economy.

Probable Cons of Privatization

Privatization will only work if private managers have incentives to work in the interest of public. However, profit and public interest might overlap in a competitive market. Limited government intervention may still be required to keep a check on privatised assets or services to bar them from acting against public interest.

It may create possibility of a natural monopoly i.e. a single company may gain expertise through acquisition of relevant CPSEs. This natural monopoly could lead to higher prices and exploitation of customers.

Different companies in the same industry can lead to fragmentation of industries and lack of accountability. For example, consider a scenario where multiple companies operate different functions within the railways and if there is an unfortunate accident, then which company shall be held responsible? Complexities are bound to increase.

Strategic Dis-investments: An Existing Phenomenon

Strategic disinvestment has been an on-going phenomenon in Modi government tenure. The new policy will give an extensive framework and roadmap of privatization for the upcoming years. Disinvestments of government stakes are a crucial source of non-tax revenue.

Recent revenue through disinvestments — INR 1 lakh crore in FY18, INR 85,000 crore in FY19 & INR 50,300 in FY20. Estimated revenue via disinvestment of PSUs in FY21 is INR 2.1 lakh crore out of which sale of oil retailer BPCL may alone generate INR 70,000–80,000 crore. The estimated revenue of INR 1.2 lakh crore is expected in FY21 via the privatization of CPSEs.

Policy Exemptions

It is expected that the government the policy may not be applicable to:

- Autonomous organizations or trusts, regulatory authorities, refinancing institutions created through Acts of Parliament — major port trusts, Airports Authority of India, etc.

- CPSEs that provide support to vulnerable groups via the financing of SCs, STs, minorities & backward classes, security printing and minting and railways & port organizations that tackle commercial operations with a development mandate.

- Departments under Railway, airport, port and national highway authorities that undertake asset monetization or privatization of activities/operations, will continue to do so even though they’re not covered under this policy.

Government keen on selling stakes in Four PSU Banks — The First Oblation

Prime Minister Narendra Modi’s office has asked officials to speed up the process of selling government stakes in at least four primary state-owned banks within the current fiscal year. The four banks are Punjab & Sind Bank, Bank of Maharashtra, UCO Bank and IDBI Bank — where the government owns majority stakes via direct or indirect investments.

Why prioritizing banks?

- To reduce the number of government-owned banks to five as the center wants to examine the banking industry and take corrective measures.

- To help raise funds for budgeted spending which is down due to low tax collection amid the economic downturn and the pandemic.

- Due to the anticipated surge in bad loan growth at the banks, which would compel the government to inject fresh funds.

What’s Next…

Employees and labours working in PSUs haven’t been supportive in this aggressive drive towards privatization. Bhartiya Mazdoor Sangh (BMS) — A RSS affiliated trade union — said on 4th June, “It (government) has no moral right or authority to sell national assets created by its predecessors. BMS is committed to fight until it stops the government from taking the anti-public sector and anti-worker decisions. BMS will launch a nationwide agitation on June 10, 2020, under the banner Save Public Sector, Save India.”

Seemingly, in response to BMS, Mr. Sanjeev Sanyal (Principal Economic Advisor to Finance Ministry), said on 5th June, “Labour laws and others in the 10 commandments, we are going to change it. We are changing it in a peculiar way. We are actually going to tighten safety and working conditions laws. We are actually introducing nationwide minimum wages. So, it’s not entirely as some people may claim titled against the labour.”

He also added, “…we know that privatization is difficult to do under these circumstances, but we want to be absolutely clear and unapologetic about what we want to do. All non-strategic PSUs (public sector undertakings) will be sold when we can do it. It’s not lack of intent that will hold us back.”