The Re-Beginnan | Vol.2 | Issue 28

FDI & FPI inflows at an all-time High in First half of FY21; A Deep Dive

What's the deal?

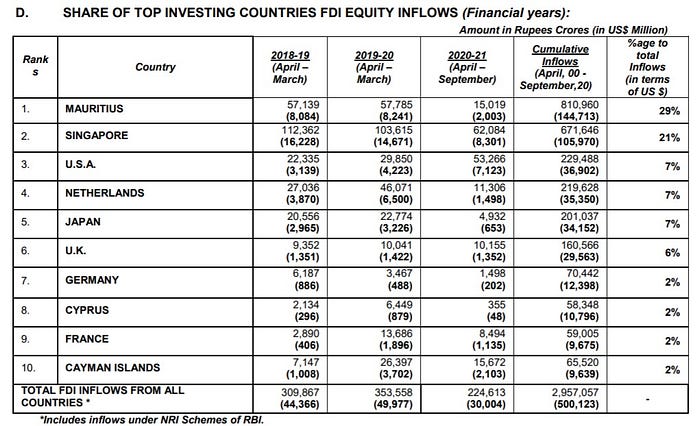

Singapore and the US become the highest FDI (Foreign Direct Investment) contributors in India in the first six months (April-September) of FY21. The US became the second-highest contributor of FDI replacing Mauritius. The biggest beneficiary of FDI inflows in the first two quarters has been the software sector, according to the data released by the Commerce and Industry Ministry.

Singapore has invested INR 62,084 crore followed by the US who invested INR 53,266 crore in inflows into India between April and September 2020. This makes Singapore and the US the biggest contributors of FDI equity inflows in India.

FPI (Foreign Portfolio Investment) investment in India crossed INR 60,000 crore mark in November and has been seen to be on an upward trend. The FPI inflow stood at INR 62,782 crore out of which equity inflows amounted to INR 60,358 & FPI net investment in debt and hybrid stood at INR 2,424 crore.

What is FDI?

In Simple Terms: When an investment is made in one country by an entity based in another country with an intent to obtain ownership stake.

Form of investment: Done via fund transfers, technology transfer, resources, etc.

GoI’s Definition: ‘FDI’ or ‘Foreign Direct Investment’ means investment through capital instruments by a person resident outside India in an unlisted Indian company; or in ten per cent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company;

What is FPI?

In Simple Terms: When an investment is made in the financial assets of a company of a particular country by an entity based in another country.

Form of investment: Done via stocks, bonds, etc.

GoI’s Definition: ‘Foreign Portfolio Investment’ means any investment made by a person resident outside India through capital instruments where such investment is less than ten per cent of the post issue paid-up share capital on a fully diluted basis of a listed Indian company or less than ten percent of the paid-up value of each series of the capital instrument of a listed Indian company.

Distinct Characteristics of FDI & FPI

The FDI Narrative

Observations from the above Table:

- Singapore and the USA respectively have been the biggest contributors to India’s FDI inflows in 2020–21.

- The third highest contributor is the Cayman Islands putting Mauritius in fourth place in 2020–21.

- A total of USD 30 billion has been pumped into the Indian economy as FDI in the last 6 months. In 2019–20 (the whole year) total FDI inflow was USD 50 billion. It is expected that the total FDI inflows of 2020–21 will beat the record of total FDI inflows of 2019–20.

- Cumulative FDI inflow in the past 20 years has been USD 500 billion. Mauritius has been the biggest contributor with a cumulative investment of USD 144.7 billion followed by Singapore with a contribution of USD 106 billion.

Observations from the above Table:

- We can notice that the highest amount of FDI was received in the month of August. This was because of the unlock and ease of restrictions in the month of August.

Observations from the above Table:

- The computer software and hardware sector has received the most amount of FDI in the last six months i.e. USD 17.5 billion. This huge investment on the tech side can be seen due to the pandemic that forced the entire world to fast forward global digitization.

- Historically the service sector receives the most amount of FDI but in 2020–21 it has taken second place due to heavy investments on the tech side.

The FPI Narrative

November 2020 witnessed the highest amount of FPI inflows ever since FPI data has been made available by the National Security Depository Ltd. This underlines the strength and resilience of the Indian economy.

Investments through FPI are gauged through the metric of net inflow and outflow as FPI flows are less resilient and more sensitive to the market conditions. In October and November, FPIs witnessed inflows. November witnessed not a single reversal. The highest inflow of FPI was marked on 12th November to the tune of a single day peak of INR 11,056 crore.

Closing Note…

Both FDI & FPI have seen positive upward trends in the first six months of FY21. Government support, India being one of the major IT hubs of the world, the overall sentiment of the country, etc. have been important contributing factors for India to witness this positive trend.